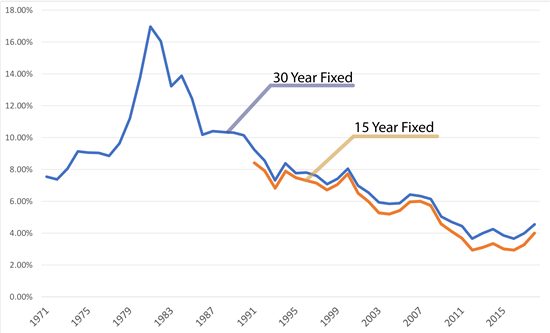

It includes the actual passion you pay to the lender, plus any type of costs or expenses. That's why a mortgage APR is commonly higher than https://www.businesswire.com/news/home/20200115005652/en/Wesley-Financial-Group-Founder-Issues-New-Year%E2%80%99s the rate of interest-- as well as why it's such an important number when contrasting financing offers. Although mortgage prices change daily, 2020 and 2021 were years of document lows for home mortgage as well as re-finance prices throughout the United States. A tracker home loan is a variable rate mortgage connected to theBank of England base ratethat climbs or falls with it. Our tracker home mortgages are readily available over a 2-year period.

- You can include your member of the family's earnings to boost the funding eligibility for the LAP Simple variation.

- Home mortgages include all sorts of various rates of interest and terms.

- The expense of a factor relies on the worth of the borrowed money, but it's typically 1 percent of the overall amount borrowed to purchase the home.

- You must do what's right for your circumstance as opposed to trying to time the marketplace.

- See just how your credit report, finance type, residence price, and also down payment quantity can influence your rate.

- Your residence may be repossessed if you do not keep up settlements on your home loan.

Discovering the ideal home mortgage bargain for you isn't only about finding the lowest interest rate. The very best bargain https://www.businesswire.com/news/home/20190911005618/en/Wesley-Financial-Group-Continues-Record-Breaking-Pace-Timeshare includes discovering the right combination of rate of interest as well as fees for you, and also understanding how to contrast deals so you can choose the right one for your Browse around this site situation. So the larger your deposit and the higher your credit history, typically the reduced your mortgage rate.

In, Most Loan Providers In Our Data Are Using Prices At Or Listed Below

It's revealed as a percent, and also if it's dealt with, it will never ever alter. Adjustable mortgage prices are repaired for a minimal amount of time, perhaps 3-10 years, and after that normally reset each year after the introductory duration. APR, or interest rate, is a computation that includes both a financing's rate of interest and also a lending's financing costs, shared as an annual expense over the life of the financing. Jumbo rates are for loan quantities surpassing $548,250 ($ 822,375 in Alaska and also Hawaii). Conforming Fixed-Rate Loans - Adhering prices are for finance amounts not surpassing $548,250 ($ 822,375 in AK and HEY THERE).

Comparing Current Mortgage Rates

IDBI Bank has two variations of home loan - Car loan Versus Home and also Financing Against Residential Or Commercial Property with Passion Saver. If this car loan is taken control of by an additional financial institution or financial institution, you will be billed a 2% charge cost on the ordinary equilibrium from the past one year. You will be charged up to Rs.500 for an increase or lower in your car loan term. All material is supplied on an "as is" basis, without any warranties of any kind whatsoever. Info from this paper may be utilized with appropriate acknowledgment. Modification of this file or its content is strictly forbidden.

What To Recognize Prior To Obtaining A Mortgage

The APR, or annual percentage rate, is expected to show a much more precise expense of borrowing. The APR computation includes charges and also price cut points, in addition to the interest rate. The Federal Book doesn't set home mortgage rates, but it does affect mortgage rates indirectly. It guides the economic climate with the twin goals of encouraging job growth while maintaining rising cost of living under control. Decisions made by the Federal Free Market Board to increase or reduce temporary interest rates can in some cases cause lenders to raise or reduce mortgage prices. Generally, each monthly settlement consists of regarding one-twelfth of the annual expense of real estate tax and homeowners insurance coverage.