While reverse mortgages don't time share resale scams have revenue or credit history demands, they still have rules about that certifies. You should be at the very least 62 years old, and also you should either own your residence free and also clear or have a substantial amount of equity (at least 50%). Debtors need to pay an origination fee, an up front home mortgage insurance coverage costs, other typical closing expenses, recurring home loan insurance premiums, funding maintenance charges, and interest. The federal government limits just how much lenders can bill for much of these items. A reverse mortgage is a home loan, generally protected by a residential property, that makes it possible for the borrower to access the https://diigo.com/0pkbia unencumbered worth of the residential property.

You may want to speak with an economic expert and your family prior to obtaining a reverse mortgage. See to it you recognize how a reverse home mortgage works as well as just how it can affect your residence equity gradually. What you'll need for a home loan application A little prep work can make the home mortgage procedure a lot less complicated. Use this checklist to collect records that might help expedite the procedure.

- If the heirs do not pay back the financing within the agreed-upon duration, the lending institution may wage repossession.

- You can make month-to-month repayments, you can pay quarterly, bi-monthly, semi-annually or all at once.

- Make acquisitions with your debit card, as well as bank from practically anywhere by phone, tablet or computer system as well as 16,000 Atm machines and also more than 4,700 branches.

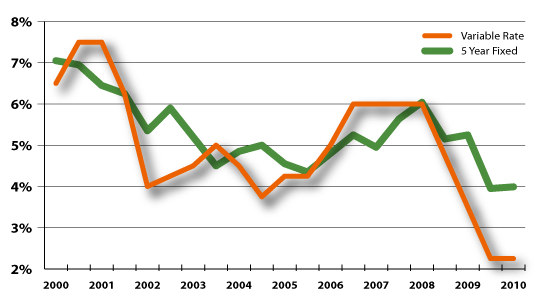

- Rates of interest might vary and the stated price might transform or otherwise be readily available at the time of lending dedication.

- Our objective is to offer you the very best suggestions to assist you make wise individual finance decisions.

- Fees will use and a brand-new assessment of your home will certainly be needed.

An HECM for Acquisition allows grownups ages 62 and up obtain a reverse home loan on their current residence, and also utilize the earnings to acquire a brand-new major home. This is generally done when you intend to move right into a new home, however do not wish to wait till your existing home is offered to do so. A jumbo reverse mortgage lets elderly owners of high-value residences obtain as much as $4 numerous their ownership risk in a residential or commercial property. Variable-rate reverse home mortgages are linked to a benchmark index, commonly the Continuous Maturation Treasury index. Regardless, you will normally require at the very least 50% equity-- based upon your home's existing value, not what you spent for it-- to get a reverse mortgage.

What Responsibilities Come With A Reverse Mortgage?

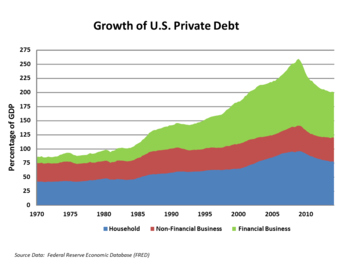

While these charges can be paid with the cash from your loan, it is still a cost to take into consideration. For a reverse home mortgage to be a practical financial option, existing home mortgage balances usually must be low enough to be settled with the reverse home mortgage proceeds. Nonetheless, borrowers do have the choice of paying for their existing home loan equilibrium to receive a HECM reverse mortgage. In get rid of timeshare for free order to receive a government-sponsored reverse home loan, the youngest proprietor of a residence being mortgaged must go to least 62 years of ages.

What Home Sale Continues Sharing Prices

While reverse home mortgages have some benefits, these finances also have considerable downsides. The lender can speed up the lending in any one of the above-described circumstances. As an example, state you do not pay the real estate tax or property owners' insurance, you do not maintain the residence in reasonable problem, or you breach the home loan terms, the lending institution can seize.

Can You Refinance A Reverse Mortgage?

That indicates the amount you owe expands as the passion on your financing builds up in time. An economic analysis is an essential action before putting on see if you'll have the ability to manage living costs, insurance as well as taxes after taking this sort of loan. Regrettably, the guarantee of reverse home loans has actually additionally been used to fraud home owners. If you live away from your home for more than 12 successive months, you may require to start paying the funding.